Global seed companies invest on average up to 20% of their annual turnover in research and development7 . Their breeding programs cover a broad range of crops and use new breeding techniques, and collaboration with numerous research institutes on pre-competitive and competitive research to further their breeding programs is common. This includes research on breeding for genetically complicated traits useful for smallholder farmers, such as abiotic and biotic stress tolerance and higher nutritional value. Many regional companies, especially those without breeding programs in sub-Saharan Africa, collaborate closely with national and international research institutes such as CIMMYT, IITA and the World Vegetable Center, with these institutes providing advanced or finalized genetic materials that regional companies market directly to farmers or finalize for marketing. Regional companies with breeding programs often limit themselves to a small number of crops and sell varieties from other seed companies for other crops.

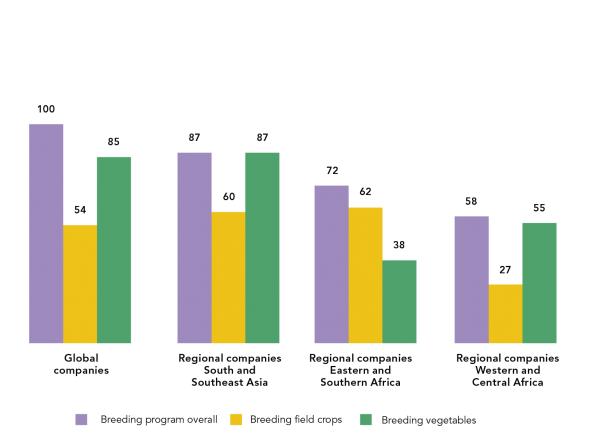

With the exception of two state-owned companies in South and Southeast Asia, all regional index companies in this region have a breeding program. For the majority of crops, the youngest variety available on the market is less than three years old, indicating that the sector is highly innovative. Some 75% of the regional companies in Eastern and Southern Africa have breeding activities. Maize dominates breeding, with significantly fewer companies actively involved in breeding other crops, raising concerns over crop diversity and adaptability within the regional seed system. In Western and Central Africa, less than half of the regional companies report having breeding programs. For almost half of the crops in their portfolio, all the varieties on offer are more than five years old. As the industry is less advanced compared to other regions, and global seed companies are less active in the region, farmers have only limited access to modern varieties.